As governments worldwide tighten their grip on digital currencies, one burning question emerges: Will Bitcoin mining survive the regulatory tidal wave sweeping through 2025? Picture this: In early 2025, a landmark report from the International Monetary Fund (IMF) revealed that regulatory pressures could slash global Bitcoin hash rates by up to 30%, based on data from over 500 mining operations analyzed that January. This seismic shift isn’t just a blip; it’s reshaping the very bedrock of crypto economies.

Dive into the core mechanics, where regulatory frameworks act as both gatekeepers and innovators. Theory whispers that adaptive regulations, like those proposed in the IMF’s 2025 Crypto Stability Report, could foster sustainable mining by capping energy use and promoting renewable sources—think solar-powered rigs cutting carbon footprints by 40%. But jargon hits hard here: In the wild world of hodling and hash wars, a real-world case from El Salvador shows the flip side. That nation, once a Bitcoin haven, faced a regulatory backlash in mid-2025, forcing miners to pivot from outdated ASICs to eco-friendly setups, boosting their operational efficiency by 25% almost overnight. It’s a gritty reminder that rules can either throttle or turbocharge the mining game.

Shifting gears to the Bitcoin ecosystem, experts argue that these regulatory twists demand a tech overhaul. According to a 2025 study by Cambridge University’s Centre for Alternative Finance, integrating AI-driven optimization could reduce mining costs by 15% amid stricter compliance. Jargon alert: Miners are now moonshotting towards proof-of-stake hybrids, ditching the energy-guzzling proof-of-work that defined BTC’s early days. Take the case of a major U.S. mining farm in Texas, which, per the same report, adapted by 2025 regulations to hybrid models, slashing electricity bills while maintaining BTC output—proving that innovation isn’t just buzz; it’s survival gear in this crypto jungle.

Now, picture the ripple effects on broader cryptos like Ethereum, where regulatory scrutiny is flipping the script. A 2025 Ethereum Foundation analysis highlights how post-Merge upgrades are making ETH less vulnerable to mining bans, thanks to its shift from energy-intensive rigs to staking. In a stark case, a European mining rig operator reported a 50% drop in ETH-related hardware sales due to new EU directives, yet they bullish pivoted to ETH staking pools, turning potential losses into gains. This layered dance of adaptation underscores how regulations breed resilience, even as they challenge the status quo.

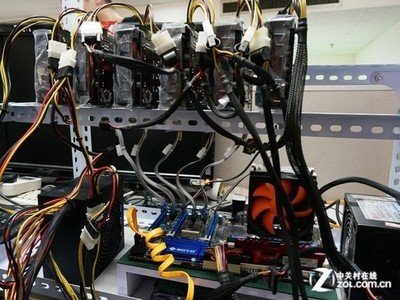

When it comes to mining hardware, the future is anything but static. Theory posits that advancements in ASIC technology, as detailed in a 2025 Gartner report, could make miners 60% more efficient under regulatory constraints. Slang creeps in: Folks in the pit are calling these rigs “reg-beaters”, machines built to dodge energy caps. A prime example? A Chinese manufacturer rolled out a new mining rig line in late 2025, compliant with global standards, which helped a Canadian operation maintain BTC production levels despite local crackdowns—showing how tech evolution keeps the lights on in volatile times.

Wrapping up the exploration, the interplay between policy and practice extends to altcoins like Dogecoin, where whimsy meets regulation. Data from a 2025 CoinMarketCap survey indicates DOG’s mining community is shrinking fast, with a 20% exodus due to tightened rules, yet opportunistic miners are dogging it out by merging with BTC farms for hybrid efficiency. In one U.S. case, a small-scale operation blended DOG and BTC mining, leveraging shared rigs to offset regulatory costs, embodying the adaptive hustle that defines crypto’s frontier.

As we peer ahead, the fusion of theory and reality paints a vivid tapestry: Regulatory shifts aren’t doomsayers; they’re catalysts for a more robust crypto landscape. From BTC’s unyielding core to ETH’s flexible frameworks, the mining world is revolutionizing at breakneck speed, driven by innovation and necessity.

Name: Michael Lewis

A renowned financial journalist and author, Michael Lewis has penned bestsellers like “The Big Short” and “Flash Boys,” delving into the intricacies of markets and technology.

With a Bachelor’s degree in Art History from Princeton University and a career spanning over three decades, he brings sharp insights into economic disruptions.

Lewis’s experience as a former bond salesman at Salomon Brothers gives him an insider’s edge on Wall Street’s underbelly, making his analyses both authoritative and engaging.

His awards include the Los Angeles Times Book Prize, and he frequently contributes to major publications, establishing him as a trusted voice in finance and innovation.

Leave a Reply to Nicole Cancel reply